The Nation

Tinubu seeks approval for New $2.2bn loan amid rising debt pressure

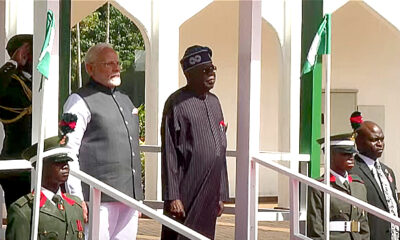

President Bola Tinubu has requested the National Assembly’s approval for a new external borrowing of N1.767 trillion ($2.209 billion) to help address Nigeria’s growing budget deficit of N9.7 trillion for 2024.

This appeal, made on Tuesday, highlights ongoing fiscal challenges as the nation grapples with significant debt servicing costs.

The announcement comes as Nigeria faces rising international debt servicing expenses, with $3.58 billion spent in the first nine months of 2024. According to Central Bank of Nigeria (CBN) data, this marks a 39.77% increase compared to the $2.56 billion spent during the same period in 2023. The highest monthly payment this year occurred in May, totaling $854.37 million.

Adding to fiscal concerns, state governments have amassed substantial debts. Reports indicate the total debt stock of Nigeria’s 36 states grew to N11.47 trillion as of June 2024, a 14.57% rise from December 2023. The devaluation of the naira has significantly compounded this burden, increasing foreign debt obligations in local currency terms. Lagos State remains the most indebted, holding 26.9% of the total foreign debt.

The National Social Investment Programme (NSIP) amendment bill and Medium-Term Expenditure Framework (MTEF) for 2025–2027 have also been submitted to parliament for consideration. As Nigeria navigates these financial challenges, state overreliance on federal revenue has been flagged as a critical vulnerability, particularly for states highly dependent on oil-linked FAAC allocations.

“32 states relied on FAAC receipts for at least 55 per cent of their total revenue, while 14 states relied on FAAC receipts for at least 70 per cent of their total revenue.

“Furthermore, transfers to states from the federation account comprised at least 62 per cent of the recurrent revenue of 34 states, except Lagos and Ogun, while 21 states relied on federal transfers for at least 80 per cent of their recurrent revenue.

“The picture painted above buttresses the over-reliance of the state governments on federally distributable revenue and accentuates their vulnerability to crude oil-induced shocks and other external shocks.”

The report provides a detailed analysis of states’ fiscal sustainability, examining how well they balance internally generated revenue against federal allocations.