The Nation

NNPCL admits indebtedness, warns of potential threat to fuel supply

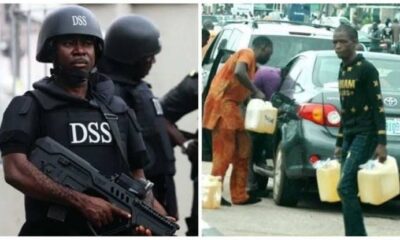

The ongoing scarcity of Premium Motor Spirit (PMS), commonly known as petrol, in Nigeria shows no signs of easing as the Nigerian National Petroleum Corporation Limited (NNPCL) has raised alarms over its ability to maintain fuel supply in the country.

This comes in the wake of widespread reports that the NNPCL is indebted to petrol suppliers to the tune of $6 billion. Although the NNPCL has confirmed that it owes suppliers, the national oil company has not disclosed the exact amount owed.

Olufemi Soneye, the Chief Corporate Communications Officer of the NNPCL, addressed the issue on Sunday, acknowledging the debt but emphasizing that the situation poses a significant risk to the corporation’s capacity to sustain fuel supplies across the country.

The fuel scarcity, which has led to long queues at petrol stations and increased transportation costs, has been a source of frustration for Nigerians, with many expressing concern over the potential worsening of the crisis.

As the NNPCL continues to grapple with financial challenges, the uncertainty surrounding fuel supply has further compounded the situation, raising fears of prolonged scarcity if the debts are not settled promptly.

The development underscores the critical state of Nigeria’s fuel supply chain, with the NNPCL’s financial health playing a pivotal role in the availability of PMS in the market.

“NNPC Ltd has acknowledged recent reports in national newspapers regarding the company’s significant debt to petrol suppliers.

“This financial strain has placed considerable pressure on the Company and poses a threat to the sustainability of fuel supply.

“In line with the Petroleum Industry Act (PIA), NNPC Ltd remains dedicated to its role as the supplier of last resort, ensuring national energy security. We are actively collaborating with relevant government agencies and other stakeholders to maintain a consistent supply of petroleum products nationwide.”