Business

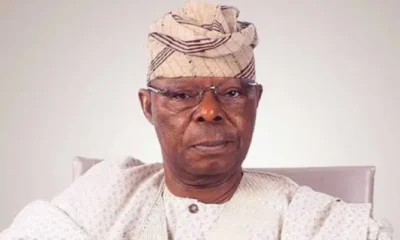

BREAKING: Court orders Nigerian Banks to blacklist media mogul Nduka Obaigbena over alleged FBN debt

The Federal High Court in Lagos has issued a Mareva order directing all Nigerian banks to blacklist media executive Nduka Obaigbena, founder of THISDAY and Arise TV, and members of his family over an alleged debt owed to First Bank of Nigeria.

The order, dated December 30, 2024, also seeks to prevent Mr. Obaigbena from transferring any assets linked to him outside the court’s jurisdiction. The directive follows a debt-recovery suit filed by First Bank, accusing Mr. Obaigbena and his family members, Efe Damilola Obaigbena and Olabisi Eka Obaigbena, of using their oil servicing firm, General Hydrocarbons Limited, to accumulate a debt of approximately $718 million.

As part of the court’s order, at least $225 million has been frozen in accounts tied to the Obaigbenas. Justice Deinde Dipeolu, who presided over the case (FHC/L/CS/2378/2024), instructed all banks operating in Nigeria to immediately halt any financial transactions involving the Obaigbenas and their affiliated businesses.

The allegations stem from claims by First Bank that the family assumed responsibility for delinquent loans linked to Atlantic Energy.

While Mr. Obaigbena has yet to publicly comment on the court’s decision, a letter from his lawyers, Abiodun Layonu & Co., accuses First Bank of attempting to coerce the family into accepting liability for debts they claim belong to Atlantic Energy.

The January 9, 2025, letter also suggests First Bank officials may be at risk of contempt of court over their actions.

The lawyers warned First Bank of “grave legal implications” for going to another judge to obtain the Mareva order when a separate federal judge already had a previous injunction prohibiting any actions against the Obaigbenas over the dispute.

The lawyers cited a December 12, 2024, judgement by Justice Lewis Allagoa of the Lagos Division of the Federal High Court, which “unequivocally and emphatically restrained First Bank from taking any steps whatsoever to enforce any security, receivables, instrument, financial documents or assets of our clients pending the hearing and determination of the ongoing arbitration proceeding between our client and the FBN.”

The firm said First Bank knew of the judgment before approaching another judge for an ex-parte order without disclosing the prior judgment, which they suggested was unethical and illegal.

A spokesman for First Bank and chairman Femi Otedola did not immediately return a request seeking comments from The Gazette about whether or not they’ve received the letter from lawyers to the Obaigbenas.

In a separate petition to CBN Governor Yemi Cardoso last year, Mr Obaigbena said he helped save First Bank from imminent collapse in 2021 when he used the resources from OML 120 oil block he secured under President Muhammadu Buhari to elevate the company’s fortunes from declaring N161 billion loss to announcing N151 billion in profits for the year ended December 31, 2021.

“We have been left with no choice but to go to court and arbitration to preserve our fundamental rights and our rights under the agreements in the face of FBN’s attempts to clubber and bully us out of existence,” Mr Obaigbena said in the November 7, 2024, complaint.