Business

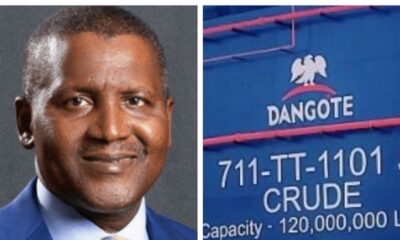

Dangote Refinery set to receive major crude shipments from US

The Dangote Refinery is poised to reshape global oil flows as it ramps up operations, according to a report by S&P Global.

The refinery, which began operations in January, has already received 18 shipments of US crude oil, making up 30% of the total 47 cargoes delivered to date.

The 600,000 barrels per day (bpd) facility, developed by Africa’s richest man Aliko Dangote, aims to achieve fuel self-sufficiency for Nigeria. S&P Global’s August 1 report highlights the refinery’s swift impact, noting that it has reached a production capacity of 400,000 bpd within six months. This output includes diesel, jet fuel, naphtha, and fuel oil for both domestic and international markets. Production of petrol is expected to commence by mid-August.

The report emphasizes that the refinery’s operations are already influencing crude oil markets. Notably, it has led to a reduction in the number of Nigerian oil cargoes being exported, as the facility imports US WTI Midland, a light, sweet crude oil. The refinery’s preference for WTI Midland and lighter Nigerian crudes is expected to tighten the market for these grades.

A West African crude trader quoted in the report suggested that the completion of the refinery’s ramp-up to full capacity could significantly disrupt the market for WTI Midland crude.

Designed to primarily process Nigerian crude, the Dangote refinery can also handle other light and medium crudes. So far, it has received about 170,000 bpd of Nigerian crude from 47 shipments, including 20 from the Nigerian National Petroleum Company (NNPC) Limited. Long-term supply contracts for US WTI Midland have been secured, favored for its competitive pricing.

As of July 31, WTI Midland was priced at $82.36 per barrel in Rotterdam, slightly lower than Nigeria’s Bonny Light at $82.80 per barrel. However, ongoing foreign exchange challenges have caused delays in unloading some WTI Midland shipments.

The report notes that the refinery’s operations have had a ripple effect on international markets, particularly in Europe, the largest consumer of Nigerian crude oil. European imports of Nigerian crude have declined since the refinery began operations, with only US oil imports decreasing more.

Increased crude supplies from Brazil, Egypt, Libya, and Guyana have been observed, while Nigeria, traditionally an exporter, has seen a significant rise in WTI Midland imports. This shift is impacting Asia and Europe, major markets for US crude.

European imports of WTI Midland have surged by 20% over the past two years, filling gaps left by sanctions on Russian oil. However, Nigerian crude exports have declined, dropping from 1.5 million bpd in Q4 2023 to 1.24 million bpd in Q2 2024.

Despite market fluctuations, the Dangote refinery has denied any allegations of reselling imported US and Nigerian crude oil.