Business

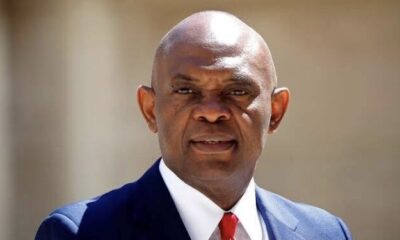

Tony Elumelu inaugurates Ucee Microfinance Bank

Tony Elumelu, the Chairman of United Bank for Africa (UBA), has officially launched Ucee Microfinance Bank (MFB), a new subsidiary of Africa’s leading investment bank and financial services group, United Capital Plc.

The launch ceremony took place on Monday in Lagos, with Elumelu joined by Ucee MFB Chairman Stephen Nwadiuko, United Capital Plc Group CEO Peter Ashade, and Ucee MFB Managing Director/CEO Esther Adeola-Balogun, to cut the ceremonial tape.

Elumelu, who is also the Chairman of Heirs Holdings, highlighted that the establishment of Ucee Microfinance Bank fulfills a long-held vision of the group.

Elumelu said, “What we’re doing today is just one per cent of making sure that we help to improve lives, create prosperity and help the society in living a more comfortable life.”

He expressed optimism that MFB would surpass collective expectations of the group, customers and the Nigerian public.

The top investment banker also expressed confidence in the ability of the MD/CEO to take Ucee MFB “beyond the shores of Nigeria.”

On his part, Mr Ashade said the Ucee MFB aimed to drive financial inclusion and increase access to capital financial services in line with the objectives of the Central Bank of Nigeria (CBN).

He said, “Our mission is simple, helping our esteemed clients to reach their financial goals and democratising access to financial services and infrastructure.”

Responding to questions from newsmen, Adeola-Balogun explained that Ucee MFB was a digitally-focused bank with the aim of bridging the gap between digital and traditional microfinance banking operations.

She added that beyond making profit, Ucee MFB was poised to make an impact in the lives of Nigerians.

She further said, “Our medium of reaching the public is by our mobile app. Our mobile app is our one stop shop for all our products and services.

“What we want to do differently is that we want to serve people both at the bottom of the pyramid and people that are up there, tech-savvy. So, our services and our products are not tailored towards the traditional microfinance bank and it is not totally tailored towards the digital microfinance bank. We are bridging the gap between the traditional and the digital.”